Bank profile

Innovations that change your world. Every day.

The first private bank in Slovakia

A leader in asset management, corporate and private banking

More than 300 awards from organizers of 30 competitions

The part of the strongest Austrian banking group RBI Group

Leader in Innovations

Tatra banka's brand promise is to be the leader in innovations and regularly offer clients new useful products that make their lives easier.

Top innovations of the past 10 years:

- 2022: Instant payments

- 2021: Lite version of the Tatra banka application

- 2020: online account opening for self employed persons

- 2019: Chatbot Adam

- 2018: Face biometrics

- 2016: Second generation of mobile phone payments

- 2015: Online banking using a smart watch

- 2014: ATM withdrawals with a mobile phone

- 2013: Voice biometrics

- 2012: Mobile payments

A bank that sets trends

When we take a look back we can see that Tatra banka launched many of the products and services that we take for granted today. Few people will remember that this bank was the first to introduce everyday products such as a credit card or internet banking in Slovakia.

Awards

Tatra banka was founded in 1990 and since then, it has won more than 300 awards granted by 30 awarding authorities.

Mission, Vision and Values of Tatra banka

Mission

We transform continuous innovation into superior customer experience.

Vision

We are the most recommended banking group in Slovakia.

Values

- Ambition

- Creativity

- Partnership

- Courage

The strategy clearly determines the direction of our bank

Years ago, we focused on innovation at our bank and thus built up a significant competitive advantage that helps us quickly adapt to new conditions in a world of constant exponential change and the ambiguity that this entails. We accept this at the same time as a challenge and an opportunity to actively participate in shaping our future.

In our current strategy, we continue to focus on innovation, but we will focus our attention on the value we bring to our clients. Because in the end, it is the client who decides our success. We therefore want to focus on innovations with clear added value for the client and with the potential to bring an exceptional client experience, even beyond the traditional banking business. We define customer experience, a comprehensive approach to the client's interaction with our products and services, for both our brands and subsidiaries, which can thus bring an exceptional experience specifically for their clients.

Regular cycles

In the context of defining and creating a strategy, we operate in our bank in regular cycles. There are times when we systematically stop, recap what we have succeeded in, look around and try to perceive the trends that we should capture in order to move in the right direction.

Therefore, in order to avoid the risk that we will look at things only from our perspective and not miss an important context, we invite top experts who guide us through the process of formulating a strategy and, so to speak, "supervise" the creation of key elements.

Expert consultants

We created the current Strategy 20.25 in collaboration with Felix Oberholzer-Gee, a professor of strategy at Harvard Business School, who, in addition to his academic career, works with global companies and helps them define their growth strategy.

We are very pleased that Mr. Oberholzer appreciated the level of our work and results. We are part of his latest book, "Better, Simpler Strategy: A Value-Based Guide to Exceptional Performance." Also on the example of Tatra banka p. Oberholzer explains the importance of a meaningful strategy based on a good understanding of the market, its communication and keeping it alive so that every employee can understand and identify with it.

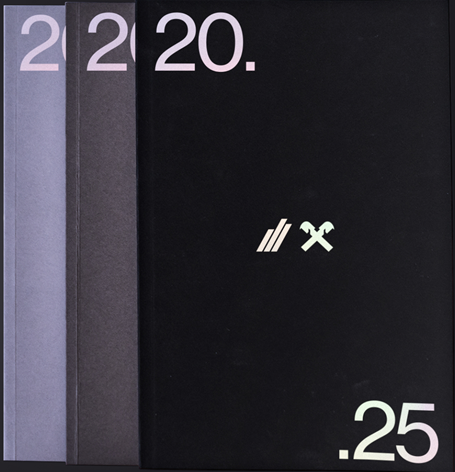

The Book of The Bank

We will then materialize the finished strategy into a book called The Book of The Bank. Every employee of the bank will receive it, which is why it is important for us to formulate a strategy so that it is simple, understandable and understandable. It consists of three books that present the same content in a different form.

We thus adapt to the individual needs of each of our colleagues, whether he prefers information in a broader context (Part I), in words (Part II) or at the level of visual perception through photographs (Part III). The same story through different eyes. In this way, employees can easily explain to their loved ones at home what our bank is about and where it is headed.

Roadmap

Of course, having a well-thought-out strategy is important. But without consistent implementation, the strategy alone would not be very important. In our bank, we use various mechanisms to get our strategy from "paper" to life. The basic execution tool that we use as the main rudder is our strategic roadmap. It helps us to regularly monitor strategic activities and key indicators or so-called KPIs (from the English Key Performance Indicators), which focus on clients and employees.

The roadmap helps us in a fundamental way to support cooperation between teams and also to understand how each of us contributes to the success of our strategy.

Quarterly measure

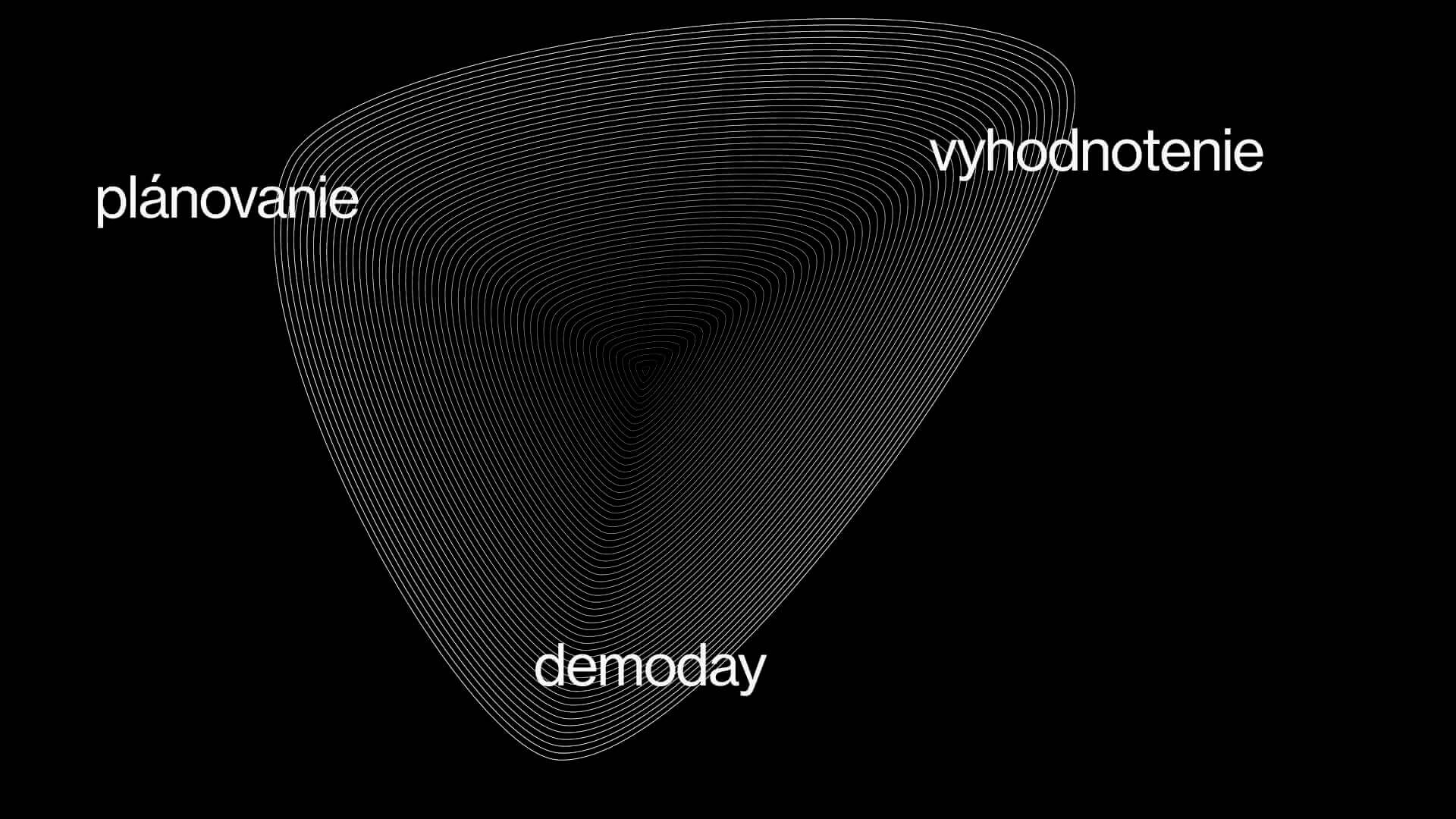

Evaluating activities on the roadmap is part of quarterly or 90-day goals - we call it quarterly. It also includes quarterly prioritization and planning of projects and requirements requiring IT deliveries.

There are three key activities on this "magic" triangle that take place in our bank every quarter.

Demo day is an event streamed to the entire bank, where colleagues present news in the form of prototypes or final solutions.

Planning consists in prioritizing requirements that require IT delivery.

The evaluation means a deduction of the activities that are listed on the strategic roadmap and should have been implemented in the past quarter and how we did in them.

20.25

Our ambition in our current strategy is not just to create a positive client experience. We want to go beyond these borders - to become the most recommended banking group on the market, thanks to the exceptional experience of our clients. Each of us is unique and has a specific role in how it affects our clients' experiences. Regardless of who we are and what position we work in the bank, we are a link in a huge chain, at the end of which is the client.

Take a look with us in the future of the most recommended banking group in Slovakia. We will be happy if you join us - see vacancies in our bank.

Approach to responsible business

At Tatra banka, we are aware of the key role that financial institutions play not only in the economy, but also in the field of sustainability. Banks lend money, invest it, manage assets and provide financial services, so it is necessary to approach finances responsibly and sustainably. Our impact is not only economic, but we can also influence the fulfillment of global sustainability goals. Therefore, the bank's approach to this topic is very active, whether it is responsible business or banking services. More detailed information and specific steps taken by Tatra banka in the field of sustainability can be found at www.premodruplanetu.sk.

Tatra banka Group

SPS from Tatra banka (Supplementary Pension Asset Management Company)

A high-standard retirement at last.

Identification information

| Business name: | Tatra banka, a.s. |

| Registered office: | Hodžovo námestie 3, 811 06 Bratislava 1 |

| Legal form: | Joint-stock company |

| Business register: | Business register of the Municipal Court Bratislava III |

| Record No.: | Section Sa, File No. 71/B |

| ID No.: | 00 686 930 |

| Tax ID: | 2020408522 |

| Business ID: | SK7020000944 |

| E-mail address: | tatrabanka@tatrabanka.sk |

| Supervisory Authority and location: | Národná banka Slovenska, Imricha Karvaša 1, 813 25 Bratislava |

https://www.tatrabanka.sk/en/about-bank/about-tatra-banka/