Pre-approved business loan

Are you looking for a quick loan for entrepreneurs without unnecessary documentation?

Redirect your payment to us and get an offer of a pre-approved BusinessLoanTB Expres.

Arrange online

Without unnecessary documents

Pre-approved limit

Simple and quick processing

What is a pre-approved loan?

A pre-approved loan is one way to quickly get money for your business.

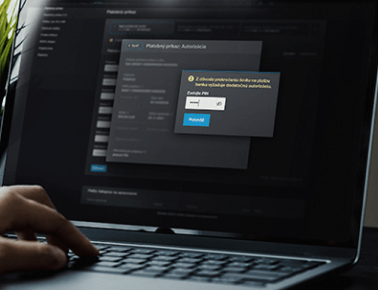

If you qualify for a loan with your financial flows, the bank will show you the offer in your mobile banking or internet banking and you can use it at any time.

A pre-approved loan is therefore often called a quick loan for entrepreneurs.

A big advantage is that the bank can grant you a loan without additional assessment based on your payment transactions on the account.

Pre-approved loan terms

- Quick loan for entrepreneurs from 1 000 EUR up to 70 000 EUR

- The amount of financing depends on the payment transaction made on the company account in Tatra banka.

- Form of loan: overdraft loan for 12 months or installment loan for a period of 1 to 6 years

Advantages of a pre-approved loan

- Pre-approved loan available for clients with a business account at Tatra banka

- The possibility to finance any investment and operational needs related to your company

- Express approval

- Securing a pre-approved loan is only in the form of a surety agreement

- Comprehensive advice in branches and via DIALOG Live

- Possibility to arrange key person insurance from UNIQA poisťovna or My company insurance from Allianz poisťovna

Where to get a pre-approved loan

After you qualify for a pre-approved loan, you will see it among the offers in the Tatra banka mobile application and Internet bankingTB. You can use the loan offer online, by phone or in a branch.

Mobile application

Apply for a loan via the Tatra banka mobile application.

Tip for you

In order to receive a pre-approved loan offer, do not hesitate to transfer your payment transaction to Tatra banka.

Documents for a pre-approved loan

- Identification document of a natural person

- Documents proving business activity (e.g. extract from the relevant register)

- Additional documentation of the necessary documents depends on the type of specific applicant and the method of processing the request

Overdraft or installment loan?

You can use the pre-approved loan in the form of an overdraft or installment loan. Both types of loans have their advantages.

An overdraft loan (so-called overdraft) is an ideal solution when you need to cover a shorter period financially. It is provided in the form of an overdraft on a company account, and you only pay interest on the amount you withdraw.

An installment loan is suitable for financing longer-term goals. You transfer the loan directly to your company account and subsequently repay it in equal monthly installments during the agreed period. You always pay interest only on the currently remaining unpaid part of the loan.

What to use a pre-approved loan for

You can use the loan funds for any operational and investment needs. These include:

- purchase of technology, machinery and other investment needs

- pre-stocking

- payment of invoices

- routine operations

- marketing support to acquire new customers

Frequently asked questions

The loan is intended for clients with business accounts at Tatra Banka: entrepreneurs, sole proprietors (even if they do not prepare financial statements and apply flat-rate expenses when calculating taxes or keep tax records) as well as small and medium-sized companies (s. r. o.).

If you qualify for a loan with your financial flows, the offer will be displayed in your mobile banking or internet banking, and you can take advantage of it at any time.

You can use the pre-approved loan offer that appears in your mobile banking or internet banking not only online, but also by phone or in a branch.

https://www.tatrabanka.sk/en/business/financing-options/pre-approved-business-loan/