High-standard retirement

What will your pension be?

According to a survey by the FOCUS agency in June 2019, a better pension is the dream of most Slovaks. As many as two thirds of us dream about a pension higher than 900 EUR. The reality is something quite different.

The current average pension is only 460 EUR and today’s pensioners live really modestly, spending only 3.30 EUR* on food a day! Can you imagine something like that?

In order to maintain your living standard in retirement we can no longer rely on the state. We ourselves are responsible for the amount of our pension.

Most Slovaks however believe that they do not have enough information on how to provide for their old-age security.

It’s simple. Just stop in at a Tatra banka branch where we will be happy to provide you information about the level of your future pension. And that’s not all. The branch staff will also advise you about how you can improve your pension.

The three pillars

Everyone knows the fairytale story about the three farthings. Likewise, everyone should know about the three pillars of our pension system, which can prevent you from spending your retirement years in poverty.

Pillar 1

The basis for the pension system is the Social Insurance Agency, which pays out the state pension (1st pillar), which operates on a pay-as-you-go financing basis. This means that money paid by the working population for their pension insurance is immediately paid out in the form of pensions to current pensioners. This money does not appreciate over time, it is simply moved from the working population to pensioners.

This system is not satisfactory, as the money collected now is already not enough for paying out pensions. The Social Insurance Agency must cover any missing funds from the state budget. In the future the situation will get even worse.

Blame the demographics

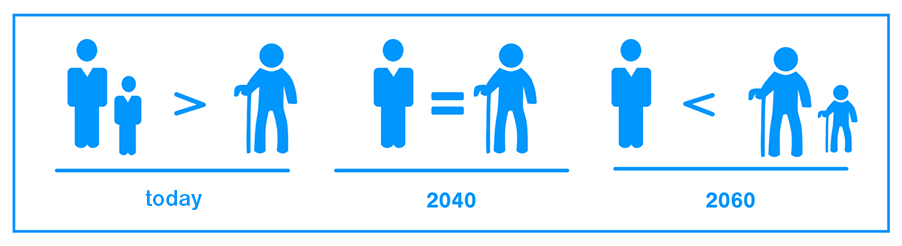

The birth rate in Slovakia is significantly lower than it was in 1970s and 1980s, and as a result the working population will decline in future and the number of pensioners will rise. At present 1.6 working people contribute to the Social Insurance Agency per pensioner. This ratio will balance out in 2040. In 2060 there will be only 0.74 working people per pensioner.

The lack of resources in the Social Insurance Agency will cause real pensions to decrease and it is likely that some future governments will have to take measures to mitigate the consequences of adverse demographics.

In addition to the 1st pillar (the state pension), everyone should also be saving in the 2nd and 3rd pillars to fulfil their dream of a better pension.

Old-age pension saving - Pillar 2 (DSS)

Part of the contributions from Pillar I is invested through a pension management company (DDS) and your pension may thus be increased by a return on investment. This type of saving does not require any extra funds of your own money.

Supplementary Pension Saving - Pillar 3 (DDS)

If you wish to maintain at least a basic living standard in your retirement, it is essential that you also save from your own money. Your employer, too, can contribute to your supplementary pension saving. Thanks to tax relief, this saving is attractive for everyone and, when correctly set, can make up for the shortfall in your income.

The golden rule of pensions says: Your pension should be at least 2/3 of your original income

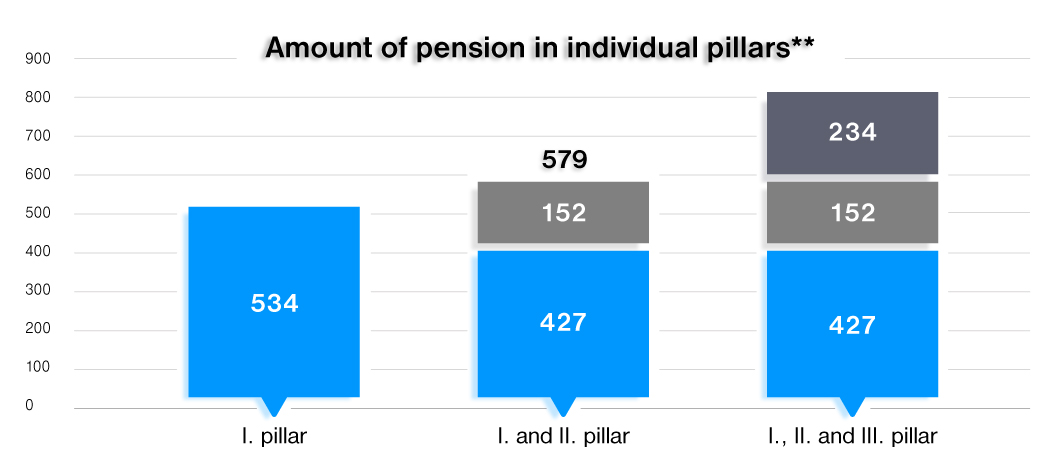

Look at the example of the probable level of a pension from the 1st pillar I and from the 1st + 2nd pillars in the case of a 30-year-old employee with secondary education and an average wage of (1,100 EUR). If this client begins to save in the 3rd pillar (25 EUR + 25 EUR employer’s contribution on a monthly basis), the estimate of his Pillar III pension would be 236 EUR over the course of 10 years and the estimate of his total pension would thus increase to 723 EUR.

Now, this income during retirement represents 2/3 of his current income, so the client would be able to maintain his living standard also in retirement.

Find out about your pension estimate at Tatra banka and begin to save towards your dream pension. The future cannot be put off.

*Source: Social Insurance Agency and Statistical Office of the SR

**Source: Research team of Matej Bel University and DDS Tatra banka, a.s.; data are calculated to current prices; in the 2nd pillar the example assumes entry in 2019 with an aggressive strategy; estimate of pension from 3rd pillar is calculated for 10 years

https://www.tatrabanka.sk/en/personal/savings-investments-insurance/pension/high-standard-retirement/