Visa Standard Private

Until we deliver the physical card to you, the digital credit card is available in your smartphone immediately after signing the Card Agreement, and you can add it to your Google Pay/Apple Pay wallet with a few clicks from the Tatra banka application.

For payments on the Internet, use the "internet payment" functionality in the Tatra banka application.

Attractive discounts at merchants thanks to My Benefit

5 % birthday cashback (max. 30 EUR)

100 % discount on the service charge with the Reward programTB

My Doctor service for your health

Fulfil your plans and dreams instantly with a credit card full of benefits:

Earn with a credit card and the My Benefit service, which brings you attractive discounts at selected merchants in the form of cashback, discount coupons and gifts.

Read more about My Benefit.

Download the Tatra banka app to get the unique My Doctor service for your credit card with 5 exclusive health benefits:

- Symptom diagnosis

- Doctor on the phone

- the possibility to order a consultation with a specialist - Priority booking for MRI examination

- Second medical opinion

- Coaches and therapists

For more information, visit My Doctor.

For your birthday you have a great gift from us. We will refund 5% of all credit card purchases * made on your birthday (maximum credit amount is € 30).

*Purchases do not include credit card payment orders, cash withdrawals, and special transactions such as foreign currency purchases, electronic money transfers, financial services and trading, financial payments to other institutions, traveler's checks, gambling, lotteries and betting

Use your credit card free of monthly fees thanks to our Reward programTB. Make payments in amount of 150 EUR and you will get 50 % monthly fee discount for your credit card. Make payments in amount of 300 EUR and you will get 100 % monthly fee discount.

The Reward programTB is subject to a main credit card fee. Additional credit cards contribute to the fulfillment of the rewards program, but are charged according to the current price list.

In the event that your credit card is lost or damaged, you can request a free replacement card via the Tatra banka mobile application, which you can use in just a few seconds.

Unique travel insurance is particularly appealing to those who want to travel without worries on vacations, business trips, or shopping abroad. In collaboration with UNIQA insurance company, we offer you annual travel insurance for just 54 EUR. It is valid worldwide, with a single trip lasting up to 90 days, and the insurance also covers your accompanying family members.*

*Spouse, partner of the insured person without age restrictions, and the cardholder's children up to the age of 18, if traveling together with the insured person.

Change the limits of your card and set the continents where you can pay by card simply in Tatra banka application or using Internet bankingTB.

In case you need to raise a claim concerning one of the transactions made with your Visa standard card, you may do so directly in the Tatra banka application. You no longer need to visit the branch, nor contact DIALOG Live or your banker. Just fill in a simple form directly in the detail of transaction, and your complaint will then be handled in a standard way.

Allows you to set your own limit up to which you want to use your credit card within a month. After reaching the limit set, we will send you a notification via b-mail.

Allows you to pay your invoices or transfer money simply and quickly to your Tatra banka account or to an account in any other bank in Slovakia.

You decide how much of the borrowed amount you want to repay – either the minimum payment or more. You can also choose from the available methods of payment: automatic instalment/direct debit, payment order or cash deposit. With automatic payment you no longer need to think about paying off your credit card - you can set the amount according to your needs.

Monthly statement sent to your e-mail address will provide you with regular overview of your credit card. The statement is also available in PDF format in Internet bankingTB and in Tatra banka mobile application.

AirRefund - pay for tickets with your credit card and get your money back in the event of a flight delay, cancellation or insufficient capacity, plus a discount on the handling fee. The service is accessible at https://visa.airrefund.com/sk/.

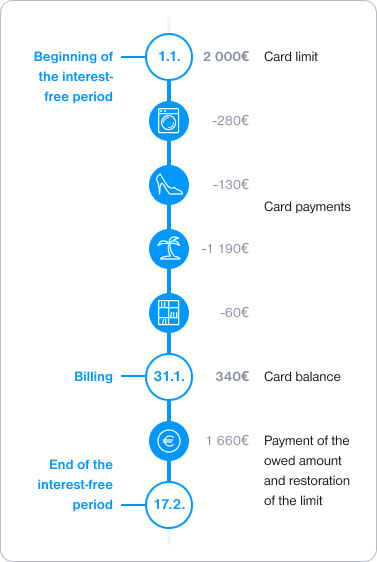

You can use the credit line of your credit card more times per month. Just repay the amount you currently need to use to your card account.

Details

- Total credit limit 400 – 5,000 EUR

-

The deadline for payment of the used amount is 17 days after billing.

- Interest rate 18.8 % p. a.

- The minimum instalment is 5% of the amount owed (at least EUR 15)

- Monthly card fee 2.50 EUR

- Monthly additional card fee 0.50 EUR

Credit card visual

TThe card shows the work Vision Pyramid (2015-2020), which was a temporary wooden sculpture/shelter that hosted a person through a section of an unstoppably changing real landscape.

Due to its location in the meadows above the village of Súľov-Hradná, under the rocks of the ridge of the Súľovské vrchy, it formed a visible target from afar. The author used it to give an opportunity for a collective and individual feeling of presence. Through the selected image of the landscape, he wanted to reflect the dimensions of our perception of ourselves.

Learn more about credit card visuals and artists themselves at ManifestTB.

Provided that the entire credit limit of 400 EUR is spent immediately via a cashless payment at a merchant and outstanding balance is subsequently repaid in 12 equal monthly installments of 39.23 EUR, the client will pay a total amount of 470.73 EUR, which includes a monthly fee of 2.50 EUR for the main Visa Standard credit card. The APR will be 37.15 % based on the assumptions. The total credit limit will be charged at an interest rate of 18.8 % p. a.

The amount of the monthly installment is used only for the calculation of a representative example. The actual amount of the monthly installment may vary and is contractually agreed.

Who is the card for?

The Visa Standard Private credit card is designed for individuals with a permanent residence in the Slovak Republic from the age of 18 on the application date.

To get a card, we just need a few important details from you depending on whether you are:

- An employee – you must submit proof of your solvency and continued employment for at least three months before filing the application for the credit card. It is important that employment is confirmed by your employer.

Self-employed or enterpreneur – you must submit proof of your trade license in the Slovak Republic, valid for at least two years, before filing an application for the credit card. You must prove your solvency by submitting proof of your income from business activities for the previous year, confirmed by the competent authorities.

A card for your relative

With a Visa Standard Private credit card, you can also apply for an additional private credit card.

To issue the card, Tatra banka will need:

- consent of the total credit limit holder, who will define the credit limit for the additional card,

- the age of the additional future cardholder (at least 15 years old)

Important:

To get a credit card, you are not required to have an account with Tatra banka.

Frequently asked questions:

You can apply for a replacement credit card in the Tatra banka application as follows:

1. In the card details, in the Options tab, select "Card blocking"

2. Select "Issue a replacement card"

3. Choose the reason for issue

4. Confirm the issue of the replacement card with your PIN

5. You will receive a confirmation of card issuance in your inbox

The plastic credit card will then be delivered to the address you entered within 10 days of submitting the application.

Leave your telephone number and we will contact you

https://www.tatrabanka.sk/en/personal/cards/visa-standard-private/