Credit card Visa Platinum

Enter the world of the unique people who enjoy premium services. Enjoy the benefits of a premium Visa Platinum credit card.

Attractive discounts at merchants thanks to My Benefit

Priority Pass

membership

100 % discount on the fee with the Reward programTB

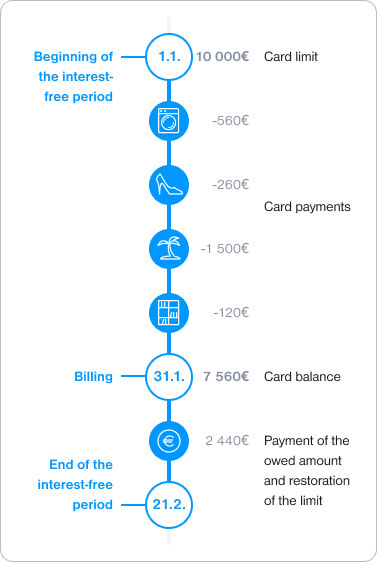

Interest-free period of up to 51 days

Enjoy all the exclusive benefits this premium credit card offers you:

Earn with a credit card and the My Benefit service, which brings you attractive discounts at selected merchants in the form of cashback, discount coupons and gifts.

Read more about My Benefit.

Thanks to the Visa Platinum card, you also get access to the offers of the Visa Benefit program.

Download the Tatra banka app to get the unique My Doctor service for your credit card with exclusive health benefits:

- Diagnosis of symptoms

- Doctor on phone with priority call

- Possibility to order a consultation with a specialist

- Priority order for MRI examination

- Second medical opinion for you and your family members

- Coaches and therapists

For more information, visit My Doctor.

Experience travel luxury and exclusivity with Priority Pass membership. Get access to over 1 500 airport lounges around the world

When entering the airport lounge, identify yourself with a digital QR code from the mobile application, which authorizes you to enter. For a full list of available lounges and their terms and conditions, visit www.prioritypass.com.

A VISA Platinum credit card holder is entitled to free entry with one accompanying person. Each additional person will be charged a fee of 30 EUR, which will be billed the following month.

Use your credit card free of monthly fees thanks to our Reward programTB. Make payments in amount of 1 000 EUR and you will get 50 % monthly fee discount for your credit card. Make payments in amount of 2 000 EUR and you will get 100 % monthly fee discount.

The Reward programTB is subject to a main credit card fee. Additional credit cards contribute to the fulfillment of the rewards program, but are charged according to the current price list.

In the event that your credit card is lost or damaged, you can request a free replacement card via the Tatra banka mobile application, which you can use in just a few seconds.

Unique travel insurance is particularly appealing to those who want to travel without worries on vacations, business trips, or shopping abroad. In collaboration with UNIQA insurance company, we offer you annual travel insurance for just 54 EUR. It is valid worldwide, with a single trip lasting up to 90 days, and the insurance also covers your accompanying family members.*

*Spouse, partner of the insured person without age restrictions, and the cardholder's children up to the age of 18, if traveling together with the insured person.

- Visa Luxury Hotel Collection

Thanks to Visa Gold card, you can also use the benefits of Visa Luxury Hotel Collection Program. The Program offers 7 premium benefits in over 900 exclusive hotels all over the world:- best available rate guarantee

- automatic room upgrade upon arrival, when available

- complimentary in-room Wi-Fi, when available

- complimentary continental breakfast

- 25 USD food or beverage credit

- VIP guest status

- late check-out upon request, when available

The benefits apply automatically, if you book your hotel via www.visaluxuryhotelcollection.com and use your Visa Gold card to pay for your booking.

- AirRefund

Pay for your plane tickets with your credit card and in case your flight was delayed, cancelled or you could not get to the plane due to its exceeded capacity, you can get your money back, with an arrangement fee discount on top of it. The service is available at https://visa.airrefund.com/en/.

Exclusive assistance service that will arrange, specify and organize anything, you no longer need to care. The service is available on the phone number +421 220 570 057 (Mon – Fri 8 a.m. – 6 p.m.). More information is available at Visa web site.

You can use the credit line of your credit card more times per month. Just repay the amount you currently need to use to your card account.

Change the limits of your card and set the continents where you can pay by card simply in Tatra banka application or using Internet bankingTB.

In case you need to raise a claim concerning one of the transactions made with your Visa Gold card, you may do so directly in the Tatra banka application. You no longer need to visit the branch, nor contact DIALOG Live or your banker. Just fill in a simple form directly in the detail of transaction, and your complaint will then be handled in a standard way.

Allows you to pay your invoices or transfer money simply and quickly to your Tatra banka account or to an account in any other bank in Slovakia.

You decide how much of the borrowed amount you want to repay – either the minimum payment or more. You can also choose from the available methods of payment: automatic instalment / direct debit, payment order or cash deposit. With automatic payment you no longer need to think about paying off your credit card - you can set the amount and the due date according to your needs.

Monthly statement sent to your e-mail address will provide you with regular overview of your credit card. The statement is also available in PDF format in Internet bankingTB and in Tatra banka mobile application.

Details

As the holder of a Visa Platinum premium card you have in your hands a tool full of privileges that are a joy to travel with, have fun with and enjoy life.

Visa Platinum never limits you. The card is accepted worldwide.

- The total credit limit from 10,000 EUR

-

The deadline for payment of the used amount is 21 days after billing.

- Interest rate 10.9 % p. a.

- The minimum instalment is 5 % of the amount owed (at least 15 EUR)

- Monthly card fee 20 EUR

- Card for your close one with a monthly fee of 10 EUR

Provided that the entire credit limit of 10 000 EUR is spent immediately via a cashless payment at a merchant and outstanding balance is subsequently repaid in 12 equal monthly installments of 902.54 EUR, the client will pay a total amount of 10 830.43 EUR, which includes a monthly fee of 20 EUR for the main Visa Platinum credit card. The APR will be 16.34 % based on the assumptions. The total credit limit will be charged at an interest rate of 10.9 % p. a.

The amount of the monthly installment is used only for the calculation of a representative example. The actual amount of the monthly installment may vary and is contractually agreed.

Credit card visual

In 1976, perhaps the most characteristic Sikor element became the enigmatic signs * —> † , signs of birth, life and death, symbolizing the endless cycle of life in the universe. Black holes were created from the concentrated and energetic vortices of these signs. First he drew them, then he worked with the negatives of the drawings in a photo booth in various non-traditional, original ways, each photographer becoming an original. He wanted to use them to visualize the human desire to be together: they are actually the concentration of all the energies of humanity, because energy is what fascinates and what makes a human being unique.

Learn more about credit card visuals and artists themselves at ManifestTB.

Who the card is for?

The card is designed for individuals with permanent residence in the Slovak Republic from the age of 18 on the application date.

To get a Visa Platinum card, we just need a few important details from you depending on whether you are:

- an employee – proof of your solvency and continuous employment for at least 3 months before filing an application for a Visa Platinum credit card. It is important that this is confirmed by your employer,

- self-employed or enterpreneur – proof of your trade license in the Slovak Republic valid for at least 2 years before filing an application for a Visa Platinum credit card. You must also prove your solvency by submitting proof of your income from business activities for the previous year confirmed by the competent authorities.

A card for your relative

With a Visa standard private credit card, you can also apply for an additional private credit card for your relative.

To issue the card, Tatra banka will need:

- consent of the total credit limit holder, who will define the credit limit for the additional card,

- the age of the future additional cardholder (at least 15 years old).

Important:

To get a credit card, you are not required to have an account with Tatra banka.

Frequently Asked Questions

If you are interested in a Visa Platinum credit card from Tatra banka, just provide your contact details via DIALOG Live and we will call you. You can also apply for this card via your Internet bankingTB or the Tatra banka mobile app, if you have a pre-authorized Visa Platinum card offer there. Or visit us at any Tatra banka branch.

You can apply for a replacement credit card in the Tatra banka application as follows:

1. In the card details, in the Options tab, select "Card blocking"

2. Select "Issue a replacement card"

3. Choose the reason for issue

4. Confirm the issue of the replacement card with your PIN

5. You will receive a confirmation of card issuance in your inbox

The plastic credit card will then be delivered to the address you entered within 10 days of submitting the application.

A Visa Platinum credit card is an ideal travel companion thanks to Priority Pass membership.

Leave your telephone number and we will contact you

https://www.tatrabanka.sk/en/personal/cards/visa-platinum/